Getting Started: How to Plant

Your First Financial Tree

Your Guide to Smart, Lifelong Prosperity

by Lan Turner

Preface: A personal note from the author

Hello, and welcome to my Ultimate Investing Guide. My name is Lan

Turner, and I created this guide to provide a straightforward, effective

approach to investing and retirement planning. It's often said that poor

people work, the middle-class work and save, but the rich work, save,

and invest. By picking up this guide, you’re taking the first step toward

not just working and saving but investing in your future. I congratulate

you on your commitment to building your wealth and securing your

financial future.

Whether you're an artist, an inventor, a healthcare professional, or a

small business owner, this strategy is designed with you in mind. I

understand that not everyone is passionate about trading, investing, or

money management, and that’s perfectly okay. We all know it’s

important, and we all know it’s something we should be doing, but

many people would rather focus on their careers and passions—be it

art, healthcare, education, or running a small business—than spend

The Ultimate Guide to Using the SCHG and SCHD

Strategy for Investing and Retirement

by Lan Turner

“Start small,

think big, and let

your financial

tree grow strong

over time.”

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

time navigating the complexities of the stock market. That’s why I

developed this simple, no-nonsense strategy.

This guide is for those who want to secure their financial future but

don’t want to get bogged down in the details of investing. You might

not have an interest in trading stocks or analyzing markets daily. You

may even find the idea of managing investments overwhelming. But

you recognize the importance of planning for your retirement and

ensuring your financial well-being. This strategy is here to provide you

with peace of mind. It's a practical approach that anyone can

implement, regardless of their investment knowledge or experience.

I’m particularly passionate about this because of my own family. I

have six sisters, none of whom are financial experts. Over the years,

they, along with their spouses and even their kids, have asked me

countless questions about saving money for big life goals—things like

buying a house, getting a car, and, of course, planning for retirement.

Not everyone has the luxury of a matching company retirement plan to

contribute to, so they need something of their own that they can rely

on. That’s who I created this plan for: my own family members. This is

the strategy I’ve taught them, and now it’s the strategy I’m sharing

with you.

Taking the first step toward investing can be intimidating. Many

people don’t know where to start or, even worse, they’re afraid of

doing the wrong thing as their first step, so they end up doing nothing.

But procrastination and inaction is the worst choice of all because it

means missing out on valuable time that could be spent growing your

wealth. Inaction usually stems from a lack of knowledge about how to

get started and what the first step should be. That’s exactly what this

guide is here to solve. It’s designed to show you the right first step and

help you take action with confidence. You can always expand and

build on this strategy in the future if you choose, but this is a fantastic

place to start. Even if you never go beyond this simple two-ETF

strategy, you'll still be doing great—better than most who delay until

it's too late, and probably even better than those who try to micro-

manage their positions.

The beauty of this strategy is its simplicity. It uses just two

ETFs—SCHG for growth and SCHD for income—to build a solid

foundation for your retirement. It’s a strategy that works whether

you’re starting your career or already planning for retirement. By

following a systematic approach, you can accumulate wealth during

PITNEWS Press: www.PitNewsPress.com: Page 3

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

your working years and transition to a stable income stream as you get

closer to retirement. You don’t need to be a financial expert to make

this work. You can set it up, follow the simple guidelines, and let your

investments grow over time.

Even for those who are active investors or enjoy trading, this strategy

can serve as a reliable core investment plan. It provides a stable base

that you can rely on, allowing you to pursue other trading ventures

with a portion of your portfolio while keeping your long-term financial

goals on track.

This guide is particularly well-suited for individuals who may not have

access to traditional retirement plans, such as 401(k)s or company

benefit programs. If you are a small business owner, a freelancer, or

someone whose job is their passion, this strategy is a great fit. It allows

you to focus on what you love while knowing that your financial

future is secure. By setting aside a portion of your income and

investing it wisely, you can take care of your future self, ensuring

financial growth, well-being, and a comfortable retirement.

Even if you do have a 401(k) or company retirement plan and you're

looking to save additional money for vacations, large purchases, or to

supplement your retirement income, this strategy is for you too. It's a

flexible and effective way to build extra financial security, allowing

you to enhance your lifestyle and enjoy the things you value most,

ensuring a safer and more secure financial future.

Thank you for taking the time to explore this guide. I hope it provides

you with a clear, actionable path to securing your financial future.

Remember, the best time to start is now, and the steps you take today

can make a significant difference to your tomorrow. Let’s get started

on this journey together, ensuring a prosperous and worry-free

retirement for you and your family.

Step-by-Step Instructions

Throughout this document, we go into detail about each step of the

strategy, explaining not only what to do but why we’re doing it.

Understanding the rationale behind each action is crucial for building

confidence and ensuring you’re making informed decisions. However,

we also recognize that it’s helpful to have a clear, concise roadmap to

follow. That’s why, at the end of this document, we’ve included a

“Plan of Action” step-by-step checklist. This checklist outlines exactly

what you need to do next, making it easy to implement the strategy

PITNEWS Press: www.PitNewsPress.com: Page 4

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

without any confusion or hesitation. There’s no excuse not to take

action and make this plan happen. Your future self will thank you for

taking these steps today to secure a prosperous and financially secure

future, whether that means a more comfortable retirement or simply

having the financial freedom to enjoy life to the fullest along the way.

Introduction

Overview of the Guide:

Welcome to a straightforward and practical guide for investors looking

to grow their wealth and secure their retirement using a simple yet

effective strategy. This guide focuses on two specific Exchange Traded

Funds (ETFs) that offer a seamless transition from growth-oriented

investing to income-focused strategies: SCHG (Schwab U.S. Large-

Cap Growth ETF) and SCHD (Schwab U.S. Dividend Equity ETF).

By leveraging these two ETFs, investors can systematically build their

wealth during their working years and gradually shift towards a stable,

income-generating portfolio as they approach retirement.

Who is This For:

This guide is designed for individuals who prefer a straightforward and

hands-off approach to investing. It’s perfect for those who may not

have the time, inclination, or expertise to manage a complex portfolio

but still want to make smart financial decisions. Whether you're just

starting your career, at the midpoint, or nearing retirement, this guide

will show you how to use a simple strategy to build and secure your

financial future without the need for constant portfolio management.

Just get started—you need to start somewhere, and this, in my opinion,

is the best way to get started today. You can always build on this

portfolio, growing into other strategies and methods of wealth building

in the future as your knowledge increases. But as we always say, the

best time to start investing was last year; the second-best time is today.

Just get started, and this is where you start. If you never go beyond this

simple two-ETF strategy, you can still be wonderfully successful at

saving and investing. For many, there is no need to go beyond this

strategy, but for some, you will—and that's great too.

Purpose:

The primary purpose of this guide is to help readers navigate their

financial journey with confidence and ease. We aim to provide a clear

roadmap that allows you to maximize your wealth accumulation

PITNEWS Press: www.PitNewsPress.com: Page 5

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

during your peak earning years and ensure a steady, reliable income

during retirement. By following the SCHG and SCHD strategy, you

can achieve a balanced approach to investing—one that grows your

assets while providing the security of regular income as you transition

into retirement. This guide will equip you with the knowledge and

tools necessary to implement this strategy effectively, ultimately

leading to a more comfortable and financially secure retirement.

1. Understanding the Two ETFs: SCHG and SCHD

What is SCH?

SCH refers to Schwab, a leading financial services company known

for its commitment to providing high-quality, low-cost investment

products. Charles Schwab Corporation, often just called Schwab, is

one of the largest brokerage firms in the United States. It offers a wide

range of financial services, including trading, investment advisory,

banking, and wealth management. Schwab's philosophy focuses on

putting investors' interests first, providing them with accessible tools

and resources to achieve their financial goals.

The company manages various ETFs (Exchange-Traded Funds), with

SCHG and SCHD being two of its standout offerings. These ETFs

allow investors to easily access diversified portfolios without needing

to select individual stocks, making them ideal for those seeking a

simple, cost-effective way to invest.

SCHG (Schwab U.S. Large-Cap Growth ETF): Focus on Growth

SCHG, or Schwab U.S. Large-Cap Growth ETF, is designed for

investors who are in the accumulation phase of their financial journey,

typically younger individuals who are working and earning income.

This ETF focuses on large-cap growth stocks—companies with a

market capitalization typically exceeding $10 billion and strong

potential for significant revenue and earnings growth.

Investment Strategy: SCHG invests in a portfolio of U.S.

large-cap companies that are expected to grow at an above-

average rate compared to other companies. The ETF's holdings

include some of the biggest names in the technology and

consumer sectors, among others, aiming to capture the rapid

growth in these industries.

Why SCHG for Younger Investors? Younger investors have a

longer time horizon and can afford to take on more risk in

exchange for the potential of higher returns. SCHG’s growth-

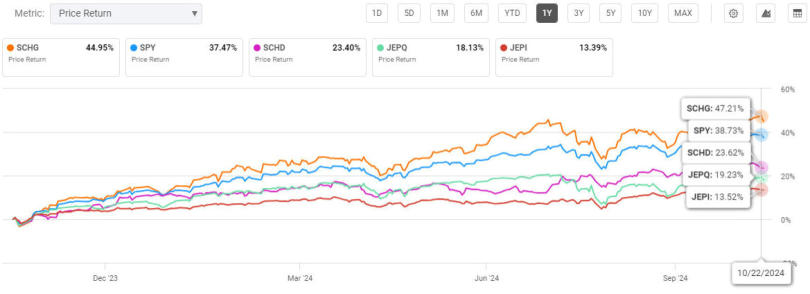

Side Note: While this document focuses on

SCHG and SCHD, I also have a strong

appreciation for JEPI and JEPQ.

Everywhere in this document where I mention

SCHG and/or SCHD, you can substitute JEPI and

JEPQ if those funds better align with your

investment goals.

The key difference between these fund pairs is

that SCHG and SCHD focus on traditional stock

ownership—SCHG for growth and SCHD for

dividend income—while JEPI and JEPQ use an

options-based strategy to generate returns.

JEPI and JEPQ sell covered calls to generate

premium income, which allows them to provide

higher yields than traditional dividend funds but

limits their potential for share price

appreciation. If your priority is maximizing

income rather than long-term capital growth,

JEPI and JEPQ can serve as strong performing

alternatives.

PITNEWS Press: www.PitNewsPress.com: Page 6

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

oriented approach aligns perfectly with this mindset, as it seeks

to provide capital appreciation over the long term.

SCHD (Schwab U.S. Dividend Equity ETF): Focus on Dividends

SCHD, or Schwab U.S. Dividend Equity ETF, is tailored for investors

looking to generate a steady income from their investments. This ETF

focuses on U.S. large-cap stocks known for their ability to pay and

grow dividends consistently.

Investment Strategy: SCHD targets companies with a solid

track record of paying dividends. These are typically well-

established firms with strong cash flow and a commitment to

returning value to shareholders through regular dividend

payments. SCHD screens its investments based on criteria like

dividend yield, dividend growth, and payout ratios to ensure

the quality and sustainability of its holdings.

Why SCHD for Income Generation? As investors near

retirement or seek income to supplement their lifestyle,

stability and reliability become more important than high

growth. SCHD's focus on dividend-paying stocks provides a

predictable income stream, making it an ideal choice for those

transitioning to or already in retirement. The consistent

dividends can serve as a reliable source of cash flow, reducing

the need to sell assets to generate income.

Complementary Nature: How SCHG and SCHD Work Together

SCHG and SCHD are designed to work together, providing a balanced

approach to investing over an individual's lifetime. While SCHG

focuses on growth and capital appreciation, SCHD emphasizes income

and stability through dividends. This dual strategy allows investors to

align their portfolios with their changing financial needs:

Early Career (Accumulation Phase): Focus on SCHG for

growth. Younger investors can take advantage of their longer

time horizon to invest heavily in SCHG, allowing their money

to compound and grow over time.

Mid to Late Career (Transition Phase): Begin shifting

towards SCHD as retirement approaches. Starting around age

50 to 55, depending on your risk tolerance—earlier for more

risk-averse individuals and later for those less risk-

averse—investors should begin the process of transitioning a

portion of their portfolio from SCHG to SCHD, following the

PITNEWS Press: www.PitNewsPress.com: Page 7

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

1% rule outlined in this guide. This shift ensures that as

investors get closer to retirement, they are more focused on

income generation and less exposed to market volatility.

Retirement (Distribution Phase): Prioritize SCHD for

income. Upon reaching retirement, a substantial part of the

portfolio will be in SCHD, providing a steady dividend

income. Meanwhile, the remaining portion in SCHG still

allows for some growth potential, helping the portfolio keep

pace with inflation and longevity needs.

This complementary nature of SCHG and SCHD offers a simple,

effective way to transition from a growth-focused portfolio in the early

years to an income-focused one in retirement, providing peace of mind

and financial security at every stage of life.

2. Why Choose SCHG for Growth?

Growth Focus: The Importance of Prioritizing Growth When

You're Young and Working

When you're in the early stages of your career, time is one of your

greatest assets. Investing in growth-oriented assets like SCHG

(Schwab U.S. Large-Cap Growth ETF) allows you to harness the

power of compounding over a long-time horizon. Growth investments

are characterized by their potential to increase significantly in value,

though they may come with higher volatility. Young investors can

typically afford to take on this risk because they have ample time to

PITNEWS Press: www.PitNewsPress.com: Page 8

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

ride out market fluctuations and capitalize on the long-term growth of

their investments. By prioritizing growth in the early years, you build a

strong financial foundation that can be shifted to more stable, income-

generating investments as retirement approaches.

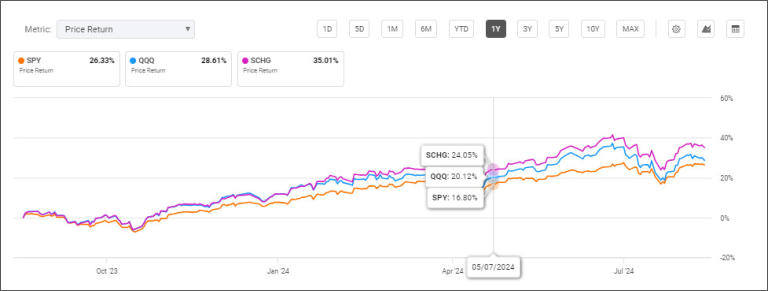

Comparative Analysis: SCHG vs. QQQ and SPY

To illustrate SCHG’s effectiveness as a growth investment, let's

compare it to two well-known market benchmarks: QQQ (Invesco

QQQ Trust) and SPY (SPDR S&P 500 ETF Trust).

SPY represents the S&P 500, a broad index comprising 500 of

the largest U.S. companies. It is widely regarded as the

standard for U.S. equity market performance.

QQQ tracks the Nasdaq-100 Index, which is heavily weighted

toward technology and other high-growth sectors.

The chart included in this guide shows the performance of SCHG

compared to QQQ and SPY over the past year. Notably, SCHG

outperformed both QQQ and SPY, with a return of 35.01% compared

to QQQ’s 28.61% and SPY’s 26.33%. This demonstrates SCHG’s

ability to provide robust growth, making it an excellent choice for

younger investors focused on capital appreciation.

Warren Buffett's Quote: A Benchmark to Beat

Warren Buffett, one of the most successful investors of all time, has

often advised that most people should simply invest in the S&P 500

and "walk away." His rationale is that beating the market is

challenging, and the S&P 500 offers a diversified, relatively low-risk

option that historically delivers solid returns. Buffett’s advice

underscores the reliability of SPY as a benchmark, emphasizing its

role in reflecting the overall health of the U.S. economy.

However, for those willing to take a slightly more focused approach,

SCHG offers the opportunity to outperform the S&P 500. While SPY

includes all sectors of the economy, SCHG zeroes in on large-cap

companies with high growth potential. This focused strategy means

that, while it may have slightly higher risk, SCHG can provide returns

that outpace the broader market, as shown in its historical

performance.

Flexibility and Performance: The Edge of SCHG

One of the key advantages of SCHG is its flexibility in stock selection:

PITNEWS Press: www.PitNewsPress.com: Page 9

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Less Diversification than SPY: SCHG is not as widely

diversified as SPY, which means it can concentrate more on

sectors and companies poised for substantial growth. This

concentration can lead to higher returns during bull markets

when growth stocks outperform.

Broader Scope than QQQ: Unlike QQQ, which is limited to

the Nasdaq-100 and thus predominantly tech-focused, SCHG is

not restricted to any single index. It can select from a broader

universe of large-cap growth stocks across all major U.S.

exchanges. This flexibility allows SCHG to balance its

portfolio by including high-growth stocks from various sectors,

not just technology, which can reduce risk and enhance returns.

Conclusion

SCHG is a powerful tool for growth-oriented investors, especially

those in their early career stages. By focusing on large-cap companies

with the potential for significant growth, SCHG offers a compelling

opportunity to build wealth over time. Its ability to outperform broader

market benchmarks like SPY and more tech-focused indices like QQQ

demonstrates its effectiveness. For investors willing to take a slightly

more aggressive stance, SCHG provides a pathway to not only meet

but potentially exceed the market's performance, setting the stage for a

robust financial future.

3. Why Choose SCHD for Income?

Income Generation: The Importance of Dividends in Retirement

As investors approach retirement, their financial needs shift from

building wealth to generating a steady and reliable income. Dividends

become a crucial component of retirement planning because they

provide a regular cash flow without the need to sell investments. This

is where SCHD (Schwab U.S. Dividend Equity ETF) excels. SCHD

focuses on high-quality, dividend-paying stocks, selecting companies

with a strong track record of consistent and growing dividend

payments. These dividends can serve as a dependable income source

during retirement, helping to cover living expenses, healthcare costs,

and other needs without depleting the principal investment. By

investing in SCHD, retirees can benefit from a predictable stream of

income that supports their lifestyle while maintaining their investment

base.

PITNEWS Press: www.PitNewsPress.com: Page 10

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Stability and Lower Volatility

One of the key advantages of SCHD is its ability to provide stability

and reduce portfolio volatility. As investors age, they typically have a

lower risk tolerance and a shorter time horizon to recover from market

downturns. SCHD helps address this by focusing on dividend-paying

stocks, which are generally less volatile than growth stocks.

Companies that consistently pay dividends are often established,

financially stable, and have a proven ability to generate cash flow. This

focus on stability makes SCHD an excellent choice for those seeking

to reduce the overall risk in their portfolio. The regular dividend

payments also act as a cushion, providing returns even in times of

market volatility.

Total Return Potential

While SCHD is primarily chosen for its income-generating capability,

it also offers the potential for total returns through modest capital

appreciation. This means investors not only benefit from the income

provided by dividends but also from the potential increase in the value

of the underlying stocks. The combination of income and growth

allows SCHD to provide competitive total returns over time, making it

a versatile investment that aligns well with both income and growth

objectives. As a result, retirees can enjoy a reliable income stream

without completely sacrificing the potential for their investment to

grow.

Sector Diversification: Balanced Exposure Across Various Sectors

SCHD’s portfolio includes a range of companies across various

sectors, ensuring that investors are not overly concentrated in any

single industry. This sector diversification reduces the risk associated

with downturns in specific sectors and provides a more balanced

approach to income investing. SCHD includes companies from sectors

such as consumer goods, healthcare, financials, and industrials, all of

which have a history of paying stable and growing dividends. This

broad exposure ensures that the ETF can maintain its dividend

payments even if one sector underperforms, offering investors a

diversified source of income that is less sensitive to market

fluctuations.

PITNEWS Press: www.PitNewsPress.com: Page 11

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Aligning with Retirement Goals: Transitioning to a Reliable

Income Stream

SCHD is a key component in aligning an investment strategy with

retirement goals. As individuals transition from the accumulation

phase to the distribution phase of their financial journey, the focus

shifts from growing assets to ensuring a reliable income stream. SCHD

supports this transition by providing a steady flow of dividend income,

which can be reinvested during the pre-retirement years to enhance

growth and then taken as cash during retirement to cover living

expenses. This flexibility allows SCHD to serve the dual purpose of

growing wealth and generating income, making it an ideal investment

for those nearing or entering retirement.

Conclusion

Choosing SCHD for income is a strategic decision for investors who

are preparing for or already in retirement. Its emphasis on high-quality,

dividend-paying stocks provides a reliable source of income, while its

lower volatility and sector diversification offer stability and risk

management. Additionally, the potential for total returns through both

income and capital appreciation makes SCHD a well-rounded

investment choice. By incorporating SCHD into their portfolio,

investors can effectively balance the need for income with the desire to

maintain and grow their wealth, ensuring financial security throughout

their retirement years.

This strategy revolves around building a strong base of income-

generating assets, specifically through SCHD, which allows you to

live off the dividends over the long term. However, the key to

maximizing your financial growth begins with SCHG. While you are

young and still accumulating wealth, the focus should be on investing

as much of your earnings as possible into SCHG for its higher growth

potential. This enables your portfolio to grow significantly over time,

benefiting from the capital appreciation of growth stocks.

As you transition from the accumulation phase to the distribution

phase, the strategy shifts towards building your income-generating

assets in SCHD. During this transition, any funds reallocated from

SCHG to SCHD should have their dividends reinvested back into

SCHD, compounding your income potential. Once you are ready to

start relying on your investments for income, typically as you

approach retirement, you should focus on accumulating as many

PITNEWS Press: www.PitNewsPress.com: Page 12

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

SCHD shares as possible. The more SCHD shares you own, the

greater your monthly dividend income will be. Since dividends are

paid out based on the number of shares you own, owning more shares

directly translates to higher dividend payouts, providing a steady and

reliable income stream that can support you throughout retirement.

Think of it this way: In your early and mid-career years, prioritize

growth by investing heavily in SCHG. Allow your investments to

grow and compound. Then, as you prepare to transition into

retirement, gradually increase your holdings in SCHD to maximize

your dividend payouts. This strategic shift ensures that as you move

from income accumulation to income distribution, you have built a

strong, stable base of dividend-generating assets to sustain your

financial needs. By following this approach, you can effectively

balance growth and income, securing a prosperous future while still

enjoying the benefits of your hard work.

4. The Practical Strategy: From Growth to Income

Start Early with SCHG: The Importance of Saving Aggressively

and Investing in SCHG During the Working Years

The foundation of a successful investment strategy is laid during the

early working years. When you’re young and earning a steady income,

your primary financial focus should be on growing your wealth. This

is where SCHG (Schwab U.S. Large-Cap Growth ETF) comes into

play. By investing in SCHG, you tap into a portfolio of large-cap

growth stocks that have the potential for significant capital

appreciation. The key is to save aggressively—every dollar you can

save and invest in these early years will benefit from the power of

compounding over time. The more you can invest now, the more your

money will grow, giving you a strong financial base to transition into

the income-focused phase later in life.

The Transition Age (55+): Introduction to the Gradual Shift from

Growth to Income

As you approach the age of 55, it’s time to start thinking about

transitioning your investment focus from growth to income. This

doesn’t mean you abandon growth altogether but rather that you begin

to prepare your portfolio for the income needs of retirement. Starting

at age 55—or earlier if you’re more risk-averse, perhaps around age

50—you gradually shift a portion of your investments from SCHG,

which is growth-oriented, to SCHD (Schwab U.S. Dividend Equity

PITNEWS Press: www.PitNewsPress.com: Page 13

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

ETF), which is income-focused. This shift is designed to balance your

portfolio between the need for continued growth and the desire for

stable, reliable income. By making this gradual transition, you ensure

that your portfolio is well-positioned to meet your financial needs as

you move closer to retirement.

The 1% Rule: A Simple, Effective Transition Strategy

To make this transition smooth and systematic, you can follow the 1%

Rule:

At Age 55: Begin by allocating 55% of your portfolio to

SCHD (the dividend-focused ETF) and 45% to SCHG (the

growth-focused ETF). This marks the start of the gradual shift

towards income generation.

Annual Adjustment: Each year, increase the allocation to

SCHD by 1% and decrease the allocation to SCHG by 1%.

This means at age 56, you would have 56% in SCHD and 44%

in SCHG. At age 57, the allocation would be 57% in SCHD

and 43% in SCHG, and so on. This annual adjustment

continues until you reach the typical retirement age of 65.

This simple rule helps to ensure that your portfolio is increasingly

geared towards generating income as you approach retirement while

still maintaining some growth exposure.

Example Scenario: Gradual Shift from Age 55 to Age 65

Let’s walk through a practical example to illustrate how the 1% Rule

works in action. Suppose you have a portfolio of $500,000 at age 55,

with 55% ($275,000) allocated to SCHD and 45% ($225,000) to

SCHG. Here’s how the portfolio allocation would change each year:

At Age 55: 55% SCHD ($275,000), 45% SCHG ($225,000)

At Age 56: 56% SCHD ($280,000), 44% SCHG ($220,000)

At Age 57: 57% SCHD ($285,000), 43% SCHG ($215,000)

…and so on.

At Age 65: 65% SCHD ($325,000), 35% SCHG ($175,000)

By age 65, you have successfully shifted the majority of your portfolio

into SCHD, positioning yourself to take advantage of its dividend

income. At the same time, you still have 35% in SCHG to provide

continued growth potential. This balanced approach ensures that your

portfolio is prepared to meet the income needs of retirement while still

PITNEWS Press: www.PitNewsPress.com: Page 14

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

growing to keep pace with inflation and extend the longevity of your

assets.

Conclusion

The 1% Rule offers a clear, manageable pathway from a growth-

focused investment strategy to one that emphasizes income. Starting

early with SCHG allows you to harness growth during your working

years, while gradually transitioning to SCHD ensures your portfolio

aligns with the changing needs of retirement. This strategic approach

not only prepares you financially for retirement but does so in a way

that reduces risk and provides peace of mind. By following this

practical strategy, you can confidently navigate the journey from

growth to income, achieving a secure and comfortable retirement.

5. Retirement and Beyond: Leveraging Dividends for

Income

Reaching Retirement: 65% in SCHD and 35% in SCHG

As you approach retirement, the gradual shift from growth to income

will have positioned your portfolio in a way that balances the need for

stability with the potential for continued growth. By the typical

retirement age of 65, following the 1% Rule, your portfolio should

consist of approximately 65% in SCHD (Schwab U.S. Dividend

Equity ETF) and 35% in SCHG (Schwab U.S. Large-Cap Growth

ETF). This allocation provides a solid foundation of income through

dividends from SCHD, ensuring a steady cash flow to support your

retirement lifestyle. Meanwhile, the remaining 35% in SCHG allows

your portfolio to continue growing, helping to combat inflation and

extend the longevity of your assets. This balanced approach ensures

that you are not overly exposed to market volatility while still

benefiting from potential capital appreciation.

Flipping the Dividend Switch: From Reinvesting to Taking Income

One of the critical transitions in retirement is moving from reinvesting

dividends to using them as a source of income. During your working

years and the early transition phase (55+), you likely reinvested

dividends from SCHD back into the fund to take advantage of

compounding and growth. However, upon reaching retirement, it's

time to flip the switch.

Instead of reinvesting, start taking your SCHD dividends as income.

This change provides a regular, predictable stream of cash that can be

PITNEWS Press: www.PitNewsPress.com: Page 15

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

used to cover daily living expenses, healthcare costs, and leisure

activities in retirement. SCHD’s focus on high-quality dividend-paying

stocks ensures that these dividends are reliable and continue to grow

over time, providing a hedge against inflation. This switch not only

helps maintain your lifestyle but also allows you to avoid dipping into

your principal investments, preserving your capital for the long term.

Continuing the 1% Shift: Further Stabilizing the Income Stream

Even after retirement, the 1% Rule remains a valuable tool for

managing your portfolio. Continuing to shift 1% annually from SCHG

to SCHD provides several key benefits:

Enhanced Stability: As you age, your investment horizon

shortens, and your need for stability increases. By gradually

increasing your allocation to SCHD, you reduce your exposure

to the market volatility associated with growth stocks. This

ongoing adjustment ensures that your portfolio becomes

progressively more income-focused, aligning with your

evolving financial needs.

Increasing Income: With each 1% shift, more of your

portfolio is invested in dividend-paying stocks, thereby

increasing the income generated by SCHD. This strategy helps

maintain or even increase your retirement income over time,

which can be particularly beneficial in offsetting rising living

costs or unexpected expenses.

Simplicity and Consistency: The 1% Rule provides a simple

and consistent approach to managing your portfolio in

retirement. It removes the guesswork and emotional decision-

making from the equation, offering a systematic way to ensure

your investments are aligned with your financial goals. This

simplicity can be especially reassuring in retirement, allowing

you to focus on enjoying your life rather than constantly

managing your investments.

Conclusion

Reaching retirement is a significant milestone, and having a solid

strategy for leveraging dividends for income is crucial to maintaining a

comfortable lifestyle. By the time you retire, with 65% of your

portfolio in SCHD and 35% in SCHG, you’re well-positioned to

benefit from a reliable income stream while still having some growth

potential. Flipping the dividend switch allows you to start using the

PITNEWS Press: www.PitNewsPress.com: Page 16

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

dividends from SCHD as a steady source of income, and continuing

the 1% annual shift ensures that your portfolio remains aligned with

your needs as they evolve. This approach not only provides financial

security but also peace of mind, knowing that your investment strategy

is designed to support you throughout your retirement years.

6. Benefits of This Strategy

Simplicity and Automation: Minimal Need for Active Management

One of the standout features of this SCHG and SCHD investment

strategy is its simplicity. It’s designed to be straightforward, making it

accessible even to those who may not have extensive investment

knowledge or experience. By using just two ETFs—SCHG for growth

and SCHD for income—investors can create a well-rounded portfolio

without the need to constantly monitor and rebalance their

investments. The 1% Rule provides a clear, easy-to-follow guideline

for gradually shifting from growth to income as one ages. This

approach allows investors to effectively "set it and forget it," relying

on a systematic strategy that automatically aligns with their changing

financial needs over time. This automation reduces the stress and

complexity of active portfolio management, giving investors peace of

mind.

Risk Management: Gradual Shift Reduces Exposure to Market

Volatility

As investors transition from their working years into retirement, their

risk tolerance typically decreases. The 1% Rule built into this strategy

offers a practical form of risk management by gradually reducing

exposure to the more volatile growth-oriented SCHG and increasing

allocation to the stable, income-focused SCHD. This gradual shift

helps protect the portfolio from significant market downturns,

particularly as the investor nears retirement age when preserving

capital becomes more critical. By slowly moving from growth to

income, investors can enjoy the benefits of both worlds—capital

appreciation during their early years and stability and income as they

approach and enter retirement. This balanced approach mitigates the

risks associated with market volatility and ensures that the portfolio

can weather various market conditions.

Income Security: Reliable and Growing Income Stream Through

Dividends from SCHD

PITNEWS Press: www.PitNewsPress.com: Page 17

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

A key benefit of this strategy is the emphasis on generating a reliable

income stream through dividends from SCHD. As investors transition

into retirement, having a dependable source of income becomes

increasingly important. SCHD focuses on high-quality dividend-

paying stocks, which provide a consistent and often growing stream of

dividends. This predictable income helps cover daily living expenses,

healthcare costs, and other retirement needs, reducing the need to sell

off investments to generate cash. By prioritizing dividend income, this

strategy ensures that retirees can maintain their lifestyle without the

anxiety of market fluctuations affecting their financial security. The

growing nature of dividends also provides a natural hedge against

inflation, ensuring that income keeps pace with rising costs over time.

Flexibility for Early Retirement: Potential to Retire Early if

Dividend Income Meets Living Expenses

Another significant advantage of this strategy is its flexibility,

particularly the potential for early retirement. By focusing on saving

aggressively and investing in SCHG during the early years, investors

can grow their portfolio quickly. As the portfolio grows, the shift to

SCHD begins, increasing the dividend income generated. If the

income from SCHD meets or exceeds the investor’s living expenses

before reaching the traditional retirement age of 65, it opens the

possibility of retiring early. This flexibility allows investors to enjoy

their retirement years sooner and with greater financial independence.

The strategy encourages saving and investing early, providing the

option to take advantage of financial freedom at an earlier stage in life.

Conclusion

The SCHG and SCHD investment strategy offers numerous benefits,

making it an attractive option for individuals seeking a straightforward

and effective approach to building wealth and securing a reliable

income in retirement. Its simplicity and automation minimize the need

for constant management, while the gradual shift from growth to

income provides a natural risk management mechanism. The focus on

dividend income ensures financial security, and the potential for early

retirement adds a layer of flexibility that can significantly enhance the

quality of life. By adopting this strategy, investors can confidently

navigate their financial journey, knowing they have a plan that adapts

to their evolving needs and goals.

7. Implementing the Strategy: Step-by-Step Guide

PITNEWS Press: www.PitNewsPress.com: Page 18

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Now that we’ve outlined the strategy and its benefits, let’s walk

through the practical steps needed to implement this SCHG and SCHD

investment plan. Whether you're just starting out in your career or

approaching retirement, these steps will guide you on how to set up,

maintain, and adjust your investments to achieve financial security and

peace of mind.

Step 1: Setting Up Accounts

The first step in implementing this strategy is to open a brokerage

account. Most major brokerage firms, including Schwab, offer

accounts that allow you to invest in ETFs like SCHG and SCHD.

Here’s how to get started:

Choose a Brokerage: Select a reputable brokerage that offers

low fees, a user-friendly platform, and access to the SCHG and

SCHD ETFs. Schwab, Vanguard, Fidelity, and others are

popular choices.

Open an Account: Follow the brokerage’s process to open a

new account. This may involve providing personal

information, verifying your identity, and linking a bank account

for funding purposes. You can choose to open a taxable

brokerage account or, for retirement savings, an IRA

(Individual Retirement Account).

Fund Your Account: Transfer money from your bank account

into your new brokerage account. Start with an initial amount

that fits your budget, and plan to contribute regularly to grow

your investment.

Purchase SCHG and SCHD: Once your account is funded,

you can begin purchasing shares of SCHG and SCHD. In the

early years, allocate most of your funds to SCHG to prioritize

growth. As you near age 55, begin purchasing more SCHD

shares according to the 1% Rule.

Step 2: Automating Investments

To simplify the investment process and ensure consistency, consider

setting up an automated investment plan:

Set Up Automatic Transfers: Arrange for regular transfers

from your bank account to your brokerage account. This could

be weekly, bi-weekly, or monthly, depending on your

preference and cash flow.

PITNEWS Press: www.PitNewsPress.com: Page 19

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Automate Purchases of SCHG: Use your brokerage’s

automated investment features to regularly buy shares of

SCHG with the transferred funds. Automating this process

helps you stay disciplined, ensuring you continue to invest in

your growth portfolio without needing to remember each

transaction.

Dollar-Cost Averaging: Automating investments allows you to

take advantage of dollar-cost averaging, which involves buying

a fixed dollar amount of an ETF regularly, regardless of its

price. This strategy reduces the impact of market volatility and

helps accumulate more shares over time.

Step 3: Rebalancing Annually

The 1% Rule is central to this strategy, guiding the gradual shift from

SCHG to SCHD as you age. Here’s how to implement it:

Annual Review: At least once a year, review your portfolio to

check the current allocation between SCHG and SCHD.

Compare this to the target allocation based on your age (e.g., at

age 55, the target is 55% SCHD and 45% SCHG).

Adjust Allocations: If the allocations are off-target, rebalance

your portfolio by selling a portion of SCHG and buying more

SCHD to align with the 1% Rule. This shift should increase

SCHD allocation by 1% and decrease SCHG allocation by 1%

each year. For example, move from 56% SCHD and 44%

SCHG at age 56 to 57% SCHD and 43% SCHG at age 57.

Use Automated Tools: Many brokerages offer automatic

rebalancing tools that can adjust your portfolio allocations

according to set parameters. Utilize these features to streamline

the rebalancing process.

Step 4: Managing Dividends

Managing dividends is a crucial aspect of this strategy, especially as

you transition from reinvestment to income withdrawal:

Set Up Dividend Reinvestment Plans (DRIPs): During your

early and mid-career years, set up DRIPs for SCHD. This

means that any dividends received from SCHD will

automatically be reinvested into purchasing more SCHD

shares. Reinvesting dividends boosts your portfolio’s growth

by compounding returns over time.

PITNEWS Press: www.PitNewsPress.com: Page 20

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Transition to Income Withdrawal: As you approach

retirement, evaluate when to switch from reinvesting dividends

to taking them as cash. This usually happens around the age of

65 when the majority of your portfolio is in SCHD. Contact

your brokerage to stop DRIPs and start receiving dividend

payments directly into your cash or checking account. This

provides a steady stream of income to cover living expenses in

retirement.

Conclusion

Implementing this SCHG and SCHD investment strategy is

straightforward and can be accomplished with just a few steps. By

setting up accounts, automating investments, rebalancing annually, and

managing dividends effectively, you can ensure your portfolio evolves

to meet your changing financial needs. The key is to start early, remain

consistent, and adjust gradually. With this systematic approach, you’ll

be well-positioned to build wealth during your working years and

enjoy a secure, income-supported retirement.

8. Considerations and Potential Adjustments

While the SCHG and SCHD investment strategy provides a solid

framework for building wealth and generating income, it’s important

to recognize that individual circumstances and market conditions may

necessitate adjustments. Here are some key considerations to keep in

mind to ensure the strategy remains aligned with your goals and

circumstances:

Market Conditions: How to Adapt the Strategy in Different

Market Environments

Financial markets are inherently unpredictable and can be influenced

by various factors, including economic conditions, interest rates,

inflation, and geopolitical events. Here’s how to adapt the SCHG and

SCHD strategy to different market environments:

Bull Markets (Strong Economic Growth): In periods of

strong economic growth, growth stocks like those in SCHG

often outperform. If you’re in the early or mid-phase of the

strategy, it might make sense to slightly overweight SCHG to

capture more growth. However, be cautious not to deviate too

far from the 1% Rule to avoid excessive risk.

Bear Markets (Economic Downturns): During economic

downturns, dividend-paying stocks in SCHD tend to be more

PITNEWS Press: www.PitNewsPress.com: Page 21

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

stable and resilient. If the market is highly volatile or

experiencing a downturn as you approach retirement, consider

accelerating the shift to SCHD beyond the 1% Rule to

prioritize income and capital preservation. This approach can

help protect your portfolio from significant losses.

Interest Rate Changes: Rising interest rates can affect both

growth and income investments. Growth stocks may suffer as

borrowing costs increase, while high-dividend stocks might

become less attractive compared to fixed-income investments.

In such scenarios, monitoring market conditions and making

small adjustments to your SCHG/SCHD allocations can help

optimize your portfolio’s performance.

Personal Circumstances: Adjusting the Strategy Based on

Individual Retirement Goals, Risk Tolerance, and Income Needs

Each investor’s situation is unique, and the SCHG and SCHD strategy

should be tailored to fit personal circumstances:

Retirement Goals: If you plan to retire earlier or later than 65,

you may need to adjust the timing of the 1% shifts. Early

retirement might require a faster shift towards SCHD to ensure

sufficient income. Conversely, delaying retirement could mean

maintaining a higher allocation to SCHG for longer to

capitalize on growth.

Risk Tolerance: Some investors may be more comfortable

with risk, while others may prefer a more conservative

approach. If you have a higher risk tolerance, you might

maintain a slightly higher allocation to SCHG, even as you

approach retirement, to maximize growth potential. If you are

risk-averse, you may want to accelerate the shift to SCHD to

prioritize stability and income.

Income Needs: Your specific income needs in retirement will

influence how much you rely on SCHD for dividend income. If

you expect higher living expenses or have fewer sources of

retirement income (e.g., no pension), you might shift more

aggressively into SCHD. If you have significant other income

sources, you could maintain a balanced allocation that includes

more SCHG for growth.

Tax Considerations: Understanding the Tax Implications of

Dividend Income and Capital Gains

PITNEWS Press: www.PitNewsPress.com: Page 22

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Tax planning is an important part of any investment strategy, and

understanding how taxes affect your income from SCHD and gains

from SCHG is crucial:

Dividend Income Taxes: Dividends from SCHD are generally

taxed as qualified dividend income, which may be taxed at a

lower rate than ordinary income. However, this depends on

your income level and tax bracket. It’s important to understand

how dividend income will affect your tax situation, especially

if you plan to use dividends as a primary source of retirement

income.

Capital Gains Taxes: Selling shares of SCHG to rebalance or

to fund retirement needs may trigger capital gains taxes. Long-

term capital gains (on assets held for more than a year) are

taxed at a lower rate than short-term gains. Planning your

withdrawals and rebalancing transactions to maximize long-

term gains and minimize tax liability is essential.

Tax-Advantaged Accounts: Consider using tax-advantaged

accounts like IRAs or 401(k)s for your SCHG and SCHD

investments. These accounts offer tax deferral on gains and

dividends, reducing your annual tax burden and potentially

allowing your investments to grow faster. Roth IRAs, in

particular, offer tax-free growth and tax-free withdrawals in

retirement, making them ideal for implementing this strategy.

Required Minimum Distributions (RMDs): If your SCHG

and SCHD investments are in tax-deferred accounts, remember

that RMDs will be required starting at age 72. Plan your

allocations and withdrawals accordingly to meet RMD

requirements while minimizing the impact on your overall

strategy.

Conclusion

While the SCHG and SCHD strategy offers a robust framework for

retirement planning, it’s important to remain flexible and adaptable.

Market conditions, personal circumstances, and tax considerations can

all influence how best to implement and adjust this strategy. By

staying informed, reviewing your portfolio regularly, and making

thoughtful adjustments, you can ensure that your investment approach

remains aligned with your financial goals, providing security and

peace of mind as you progress through your financial journey.

PITNEWS Press: www.PitNewsPress.com: Page 23

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

9. Frequently Asked Questions

What if I want to retire before 65?

Retiring before the traditional age of 65 is certainly possible with this

strategy, especially if you have saved aggressively and invested wisely.

If you’re considering early retirement, you can adjust the 1% Rule to

accelerate the shift from SCHG to SCHD. For example, you could

start reallocating at an earlier age or increase the annual shift from 1%

to 2% or more, depending on your income needs and risk tolerance.

The key is to ensure that by the time you retire, a substantial portion of

your portfolio is in SCHD to generate sufficient dividend income to

cover your living expenses. Additionally, consider other sources of

income, like part-time work or other investments, to bridge the gap

until your portfolio generates enough income to sustain you

comfortably.

How do I know when to start taking dividends as income?

The decision to start taking dividends as income rather than

reinvesting them typically aligns with your transition into retirement.

A good rule of thumb is to begin withdrawing dividends when you

stop working full-time and start relying on your investment portfolio

for daily living expenses. This usually occurs around age 65 but could

be earlier if you’ve planned for early retirement. Review your budget

and income needs to determine when your dividend income will be

necessary to meet your financial goals. Once you’re ready, you can

contact your brokerage to switch from a Dividend Reinvestment Plan

(DRIP) to receiving dividend payments directly into your cash or

checking account. It’s important to have a clear understanding of your

income needs and ensure that your portfolio is structured to meet them

consistently.

What happens if the market drops significantly?

Market downturns are a natural part of investing, and having a strategy

in place helps manage these periods of volatility. If the market drops

significantly, SCHG, being growth-oriented, might experience more

volatility than SCHD. However, the gradual shift to SCHD as you age

helps mitigate this risk, as SCHD’s focus on dividend-paying stocks

provides more stability. During a downturn, dividends from SCHD can

continue to provide income, even if the market value of the

investments declines. If you’re close to retirement and the market

drops, consider accelerating the shift from SCHG to SCHD to further

PITNEWS Press: www.PitNewsPress.com: Page 24

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

reduce risk and protect your portfolio. It’s also important to avoid

making impulsive decisions; staying invested and following your long-

term strategy is often the best course of action during market volatility.

Remember, downturns can be an opportunity to buy more shares at

lower prices, enhancing long-term growth prospects when markets

recover.

Can I use this strategy if I have other retirement accounts or

pensions?

Absolutely! The SCHG and SCHD strategy can complement other

retirement savings plans, such as 401(k)s, IRAs, or pensions. You can

implement this strategy within tax-advantaged accounts like a Roth

IRA or traditional IRA to benefit from tax deferral or tax-free growth.

If you have a pension or other guaranteed income sources, you may

have more flexibility with the SCHG and SCHD strategy. For instance,

you might maintain a higher allocation to SCHG for continued growth,

knowing that your pension provides a safety net. Alternatively, you can

use SCHD to supplement pension income, ensuring that your overall

retirement income meets your needs. The key is to consider your total

retirement income picture and integrate the SCHG and SCHD strategy

in a way that aligns with your goals, risk tolerance, and financial

needs.

Conclusion

The SCHG and SCHD investment strategy is versatile and adaptable,

making it suitable for various retirement plans and circumstances. By

addressing common questions and potential scenarios, this FAQ

section helps ensure that investors can confidently navigate their

financial journey, regardless of when they plan to retire, market

conditions, or the presence of other income sources. With careful

planning and thoughtful adjustments, this strategy can provide a clear

path to a secure and comfortable retirement.

10. Conclusion

Summary of the Strategy

The SCHG and SCHD investment strategy provides a simple and

effective roadmap for managing your financial journey from the early

stages of wealth accumulation through to a comfortable retirement.

The approach revolves around two core ETFs: SCHG (Schwab U.S.

Large-Cap Growth ETF) for growth during your working years and

SCHD (Schwab U.S. Dividend Equity ETF) for generating a steady

PITNEWS Press: www.PitNewsPress.com: Page 25

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

income stream as you near and enter retirement. The key to this

strategy is the gradual, systematic shift from growth to income, guided

by the 1% Rule. Starting at age 55, you begin reallocating 1% of your

portfolio annually from SCHG to SCHD, ensuring that your

investments align with your evolving financial needs. By age 65, your

portfolio is positioned to provide both stability and a reliable income

through dividends, allowing you to enjoy a financially secure

retirement.

Encouragement to Start Now

The best time to start this investment strategy is now. Whether you are

just beginning your career or already approaching retirement, taking

proactive steps toward your financial goals is essential. The earlier you

start saving and investing, the more time your money has to grow and

compound. Consistency is key—by regularly contributing to your

investment portfolio and following the outlined strategy, you set

yourself up for long-term success. Don’t wait for the perfect moment;

begin implementing this strategy with whatever resources you have

available today. Over time, these small, consistent efforts will

accumulate into substantial wealth, providing you with financial

freedom and peace of mind.

Long-term Outlook

The SCHG and SCHD strategy is designed with a long-term outlook in

mind, offering a balanced approach that caters to both growth and

income needs. By focusing on growth early on and transitioning to

income as retirement approaches, this strategy helps protect against

market volatility while ensuring a reliable income stream for your later

years. The systematic nature of the 1% Rule simplifies decision-

making and keeps your portfolio aligned with your changing needs.

With the combination of capital appreciation and dividend income, this

approach provides a robust framework to support a secure retirement.

With confidence in this strategy, you can navigate the ups and downs

of the market, knowing that you have a plan tailored to both grow your

wealth and provide stability when you need it most. By following the

SCHG and SCHD strategy, you position yourself for a prosperous

retirement, where you can enjoy the fruits of your hard work with the

assurance that your financial future is secure.

PITNEWS Press: www.PitNewsPress.com: Page 26

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

What to Do Next: Step-by-Step Checklist

Step 1: Open a Brokerage Account

Choose a reputable brokerage firm that offers access to ETFs

like SCHG and SCHD. Some popular options include Schwab,

Vanguard, and Fidelity.

Follow the brokerage’s process to open a new account. Decide

whether you want a taxable brokerage account or a tax-

advantaged account like an IRA for retirement savings.

Provide necessary personal information, verify your identity,

and link your bank account to fund your brokerage account.

Side Note: It’s worth mentioning that you can create two separate

portfolios that follow this same strategy—one for retirement in a Roth

IRA and another in a taxable account for long-term savings. Both

portfolios would function exactly the same, with the same allocations

to SCHG and SCHD. The key difference is that the Roth IRA is geared

toward building wealth for retirement, benefiting from tax-free growth,

while the taxable account is a flexible tool for achieving other life

goals. The taxable account can be used to pull profits along the way to

fund large purchases, vacations, or simply to enhance your lifestyle as

you live your dream.

However, don’t let this idea complicate your forward progress. If

having two accounts sounds like a good idea but seems complicated,

don't let it sideline or derail you from moving forward. Take one step

at a time—you can always add the other type of account later. Start

with one account, implement the strategy, and once you're

comfortable, you can circle back around and add the other.

Step 2: Fund Your Account

Transfer an initial amount of money from your bank account to

your new brokerage account.

o

Nowadays, most brokerage firms use a straightforward

cell phone app that can manage all this for you.

o

Simply install the app on your phone, link your

checking account by entering your account number and

bank routing number, and specify the amount of money

you want to transfer. The app will handle the transfers,

allowing you to set the amount and frequency.

o

Many apps even allow you to set up transfers on a

timed schedule, so the process happens automatically

PITNEWS Press: www.PitNewsPress.com: Page 27

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

behind the scenes on a regular basis. This is what I

recommend, as consistency is the key to long-term

success. Even if it’s a small amount each week or

month, you can always add larger amounts as the

money comes. This method is called dollar-cost

averaging and helps smooth out the highs and lows of

market fluctuations.

Step 3: Purchase SCHG and SCHD ETFs

Start by purchasing shares of SCHG (Schwab U.S. Large-Cap

Growth ETF) to focus on growth during your early working

years.

If you are age 55 or older, begin to allocate a portion of your

funds to SCHD (Schwab U.S. Dividend Equity ETF) to start

the transition toward income generation.

Step 4: Automate Your Investments

Set up an automatic investment plan through your brokerage to

regularly buy shares of SCHG. This can be done by scheduling

automatic purchases using the funds transferred from your

bank account.

Use dollar-cost averaging by investing a fixed dollar amount

regularly, which helps reduce the impact of market volatility.

Step 5: Implement the 1% Rule Starting at Age 55

At age 55, shift your allocation to 55% in SCHD and 45% in

SCHG.

Each year, increase the SCHD allocation by 1% and decrease

the SCHG allocation by 1%. For example, at age 56, move to

56% SCHD and 44% SCHG.

Continue this annual adjustment until you reach your desired

retirement age (e.g., 65), when your allocation will be 65%

SCHD and 35% SCHG.

Step 6: Rebalance Your Portfolio Annually

Review your portfolio at least once a year to ensure it aligns

with the target allocation based on the 1% Rule.

Make adjustments by selling a portion of SCHG and buying

more SCHD as needed to maintain the correct allocation.

Use your brokerage’s automatic rebalancing tools if available

to simplify this process.

PITNEWS Press: www.PitNewsPress.com: Page 28

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Step 7: Manage Dividends Effectively

Set up a Dividend Reinvestment Plan (DRIP) for SCHD to

automatically reinvest dividends back into more shares during

your working years. This reinvestment allows your dividends

to compound over time, increasing your shareholding and

future dividend income.

As you approach retirement (typically around age 65), switch

from DRIP to taking dividends as cash to generate a steady

income stream. This switch will provide you with a regular

source of income to cover living expenses without having to

sell shares.

Flip the switch in your trading software to change your

dividend preferences from reinvestment to income withdrawal.

o

The app will then start putting your dividends into your

brokerage cash account. From there, you can set up an

automatic withdrawal to your checking account on a

regular schedule—bi-weekly, or monthly—based on

your preference. This automated system ensures that

your dividend income is easily accessible and

consistently available to support your lifestyle during

retirement.

Step 8: Monitor Your Progress and Adjust as Needed

Regularly review your investment strategy to ensure it

continues to meet your financial goals and needs.

Consider making adjustments based on market conditions,

changes in your income needs, or significant life events (e.g.,

early retirement, unexpected expenses).

Stay informed about your investments and continue to educate

yourself on other wealth-building opportunities as your

knowledge grows.

Step 9: Stay Committed and Consistent

Remember, the key to success is starting early and staying

consistent. Regularly contribute to your investment account,

even with small amounts.

Avoid making impulsive decisions based on short-term market

fluctuations. Stick to the long-term plan outlined in this guide.

PITNEWS Press: www.PitNewsPress.com: Page 29

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Reassure yourself that this simple, effective strategy is

designed to grow your wealth and secure your financial future,

regardless of market ups and downs.

Step 10: Revisit and Revise as Needed

Reevaluate Your Strategy Periodically: As you approach

retirement or if your financial circumstances change, take the

time to review your investment strategy. Ensure that your

portfolio still aligns with your current lifestyle, goals, and

income needs. Adjust the allocations between SCHG and

SCHD if necessary to better suit your evolving situation.

Consider Expanding Beyond the Two-ETF Strategy: While

this simple strategy provides a solid foundation, as your

knowledge and comfort with investing grow, you may wish to

explore additional investment options. You can incorporate

other asset classes, ETFs, or strategies to further diversify and

optimize your portfolio.

The Importance of Starting and Staying Flexible:

Remember, the most critical step is getting started. This two-

ETF strategy gives you a reliable base to build on, providing

security and growth. If you choose to expand beyond this

initial plan, you’ll have a strong starting point to explore more

complex investment avenues. But even if you stick with just

SCHG and SCHD, you can still achieve excellent long-term

results.

Advanced Considerations

Deciding how to allocate a large sum like $600,000 into an investment

like SCHD involves balancing the desire for immediate dividend

income with the need to manage market risk. Here are some

considerations and strategies for moving your money into SCHD:

1. Lump Sum Investment vs. Dollar-Cost Averaging (DCA)

Lump Sum Investment:

o

Pros:

Immediate Exposure: You get full exposure to

the market right away, which means you start

earning dividends on the entire $600,000

immediately.

Historically Higher Returns: Studies have

shown that lump-sum investing often leads to

PITNEWS Press: www.PitNewsPress.com: Page 30

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

higher returns than DCA because markets

generally trend upwards over time. This strategy

takes full advantage of market growth from the

outset.

o

Cons:

Market Timing Risk: If the market drops shortly

after you invest, your portfolio could experience

a significant decline in value, which might be

uncomfortable or financially challenging,

especially if you plan to live off dividends.

Psychological Impact: A large, immediate drop

in your investment’s value can be stressful and

may lead to poor decision-making, such as panic

selling.

Dollar-Cost Averaging (DCA):

o

Pros:

Reduced Market Timing Risk: By investing

gradually (e.g., $10,000 a week), you reduce the

risk of entering the market at a high point. DCA

smooths out your entry price over time, which

can be less stressful.

Less Psychological Pressure: Smaller

investments over time make market fluctuations

less daunting, which can help you stick to your

plan and avoid emotional reactions.

Flexibility: Allows you to monitor market

conditions and adjust the pace of investing if

needed (e.g., accelerating during market dips).

o

Cons:

Potentially Lower Returns: If the market rises

steadily, DCA can result in a higher average

purchase price than investing a lump sum at the

beginning. This could lead to lower overall

returns.

Delayed Income: Since you're not investing the

entire amount upfront, it will take longer to

reach the full dividend income potential.

2. Current Market Conditions

PITNEWS Press: www.PitNewsPress.com: Page 31

Lan Turner: SCHD & SCHG vs. JEPI & JEPQ

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Consider the state of the market when making your decision. If

the market is experiencing high volatility or is at historical

highs, DCA might help mitigate the risk of a significant

downturn shortly after investing. Conversely, if valuations

appear reasonable or the market is in a downturn, a lump sum

investment might make sense to capture potential recovery and

growth.

3. Hybrid Approach

Combining Lump Sum and DCA:

o

Invest a portion of the $600,000 upfront to begin

earning dividends immediately (e.g., $200,000).

o

Gradually invest the remaining amount using DCA

(e.g., $10,000 per week) over a set period (e.g., 40

weeks).

o

This approach balances the benefits of both strategies,

providing some immediate exposure while reducing

timing risk for the remaining funds.

4. Consider Your Income Needs and Time Horizon

Immediate Income Needs: If you need the full dividend

income right away to cover living expenses, a more significant

initial investment may be necessary. You can still use DCA

with a large starting amount to meet your income requirements.

Time Horizon: If you have a longer time horizon and don’t